why Investing in an Indexed Universal Life (IUL) Policy can be a bad investment.

IUL is said to be a bad investment by people because it’s filled with high fees, hidden charges, and excessively complicated terms that benefit the insurance company more than the policyholder. Returns are limited, loans lead to tax liabilities, and most investors receive a lot less than they were assured.

In some discussion webiste this is what people has to say about it.

- “In almost every situation, buying an IUL is a poor financial decision.” Insurance salespeople adore selling it because they receive an enormous commission from it.”

- “IUL policies are expensive and lack transparency. It’s crucial to carefully compare the costs against the potential returns, especially when weighed against something straightforward like a total market index fund.”

- “Cost of insurance increases in the policies annually and can devour cash value … there are just too many non-guaranteed components … this is particularly the case for IUL.”

- “IUL and whole life contain many more hidden charges … Avoid them. Purchase a term policy … invest the rest in an ETF.” The hefty premium and fee cost renders IULs costly and much less affordable than term life.”.

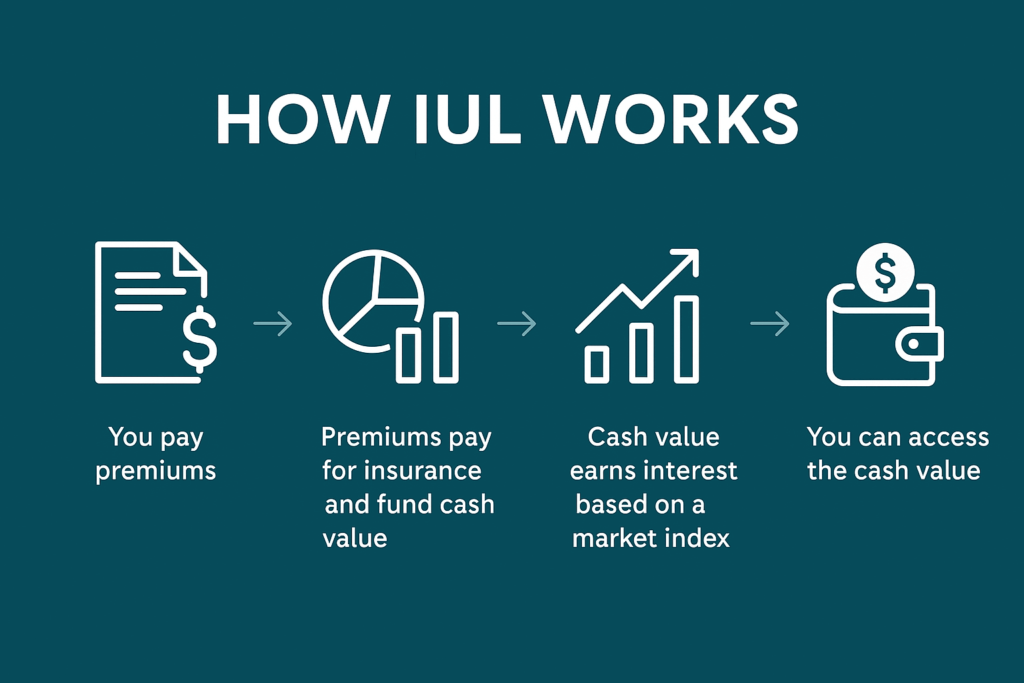

How IUL Works?

Indexed Universal Life (IUL) insurance is a form of permanent life insurance that blends old-fashioned universal life insurance with a component for investment.

Similar to old-fashioned life insurance, you pay regular premiums to have and keep an IUL policy.

Some of your premiums go toward paying the policy’s death benefit, and the rest goes into a cash value savings account, which is invested in a market index (e.g., the S&P 500).

The performance of the market index you have selected will drive your cash value account growth. If the index does well, your cash value account could grow.

Although there are drawbacks to be aware of, you can borrow from your cash value account or use it to pay premiums on your policy.

The sales presentation for IUL policies usually highlights the following:

- Protection against market losses with a “floor” on loss

- Potential for attractive returns on investment

- Tax-free accrual and tax-free withdrawals

- Capacity to “be your own bank” by lending against the policy

- Though the sales pitch is appealing, IUL policies are much more complicated and much less favorable than the pitch.

To illustrate, your investment return is not directly related to the stock market.

The IUL Policy Complexity: What They Don’t Want You to Know

Indexed Universal Life (IUL) insurance has been marketed as a clever, no-frills method of covering life while building investment value. Sales reps make it sound so easy—just pay premiums, see your cash value increase, and collect tax-free benefits down the road. But behind the veil, you’ll discover that these policies are not quite so straightforward.

An IUL policy is riddled with fine print, technical jargon, and secret provisions that can quickly overwhelm even the financially intelligent. Beyond the glitzy advertising, you will be presented with a labyrinth of charges including:

- Administrative fees that nibble away at your account balance each month.

- Insurance fees that increase over time as you get older, gradually depleting your cash value.

- Premium expense fees that cut back on how much of your money actually gets invested.

- Surrender fees that charge you exorbitantly if you attempt to leave during the first 10–15 years.

In addition, your cash value accumulation is not really connected to the performance of the stock market. Rather, it’s at the mercy of the insurer’s conditions:

- Participation percentages cap the amount of index growth you get to keep.

- Gains caps limit your gains regardless of the market’s performance.

- Floors on losses protect you during down years, but the trade-off is severely restricted growth.

Moreover, the “flexible premium” option—frequently touted as a plus—can turn against you. Should your policy fail to perform, you might be compelled to pay higher premiums simply to prevent its collapse. And if you use loans against the cash value to supplement retirement income, you could end up with lower death benefits, surprise tax bills, or even a total policy lapse if not carefully managed.

10 Reasons Why IUL is a Bad Investment

Let break down 10 clear reasons why IUL is a bad investment, exposing the hidden traps insurance companies don’t want you to know. By the end, you’ll see why these policies are often more beneficial to the agents selling them than to the people buying them.

1. High Fees and Hidden Costs

One of the largest issues with IULs is that they are really expensive and have a layered fee structure. Mutual funds and ETFs may have an expense ratio below 0.20%, but IUL policies can range from 3–5% or even higher on an annual basis if you combine everything. That’s a huge subtraction from your growth potential over the years.

- Premium Allocation Charges: A portion of each premium payment directly goes into paying sales commissions and insurance fees. That leaves less of your money invested in the index.

- Administrative and Policy Fees: These are regular monthly fees that pay for the insurance company’s “operating expenses.” Just think of them as service fees that don’t vaporize over time.

- Cost of Insurance (COI): This premium goes up as you age, nibbling away at policy value. Early in the game, the charges appear modest, but across decades, the price explodes.

The synergistic impact of the fees can be cataclysmic. Take $1,000 a month and put it into a low-expense index fund with a 7% return per year—you’d have nearly $1.2 million in 30 years. Place the same amount into an IUL with fees and caps, and you may have less than half of that.

Agents usually don’t emphasize this since their commissions are based on the size of the policy. Many agents actually receive enormous up-front commissions (in some cases, a year’s worth of your premiums), so they do have an incentive to peddle these aggressively. That comes straight out of your pocket, unfortunately.

2. Misleading “Tax-Free Retirement” Promises

One of the most attractive selling points of IUL is the so-called tax-free retirement strategy. Agents love to say, “You’ll be able to borrow from your policy tax-free and live off it in retirement.” While technically true, it’s extremely misleading.

Here’s the reality:

- Policy Loans Are Not Free Money: You’re not withdrawing your money—you’re borrowing it from the insurance company, using your cash value as collateral. That means you’ll pay interest on the loan.

- Interest Charges Add Up: If your policy isn’t earning enough returns to offset the interest, your balance can shrink dramatically.

- Tax Implications if Policy Expirations: If your policy depletes the cash value and expires, all those loans then become taxable income. Picture this when retired, assuming tax-free income, only to find that the IRS has a monster tax bill on your hands.

The “tax-free” aspect is actually a marketing ploy. Unlike Roth 401(k)s or Roth IRAs, where the distributions are really tax-free, the tax benefits of IULs come with caveats. One misplaced step—such as missing premium payments or allowing the policy to lapse—can utterly blow up in your face.

3. Poor Investment Returns

Another huge disadvantage of IULs is that they just don’t give competitive returns to investing in the stock market directly.

Here’s why:

- Caps on Gains: Insurance companies tend to limit annual gains between 8–12%. So even if the S&P 500 climbs 20% in one year, your account may only experience 10% (or less).

- Participation Rates: Most policies limit you to receiving only 50–80% of the growth in the index. That’s a guarantee that even if the market is rising, you’re not going to see the full amount.

- Spreads and Fees: On top of that, spreads and internal fees reduce your credited interest even more.

Across decades, these limitations accumulate to a gigantic disparity in growth. Historically, the stock market has averaged about 10% return per year. Post-caps, spreads, and fees, IULs typically yield between 3–6%. That’s just slightly better than inflation.

When pitted against a plain vanilla S&P 500 index fund—no caps, no participation limits, and low fees—the IUL comes up embarrassingly short. And yet, insurance companies still sell it to us as a “market-like” investment. The reality is, it’s not even in the same ballpark.

4. Complexity and Lack of Transparency

IUL policies are notoriously complicated, and that makes them unsafe for the typical investor. Unlike simple investments such as index funds, IULs are loaded with dynamic components that most individuals do not completely grasp.

- Hard to Comprehend: With caps, floors, spreads, participation rates, policy charges, and loan provisions, the typical individual has no clue how their money is really functioning within the policy.

- Agent Incentives: Agents tend to show too-conservative projections to make the product appear better. They emphasize the positive and downplay or even omit the negatives.

- Hidden Risks: Due to the complexity, many people have no idea what risks they’re taking until years later when it’s too late to withdraw without huge surrender charges.

This opacity works to the insurance company’s and the agents’ advantage—not the policyholder’s. Insurance products should be straightforward enough that you can describe them to your friend in five minutes. If you can’t do that with an IUL, that’s a red flag.

5. Risk of Policy Lapse

One of the most threatening features of IUL is policy lapse risk. If your policy lapses, the financial impact can be ruthless.

Here’s what happens:

- If you miss making premium payments or if your cash value isn’t high enough to pay for the increasing cost of insurance, the policy can fail.

- When that occurs, any unpaid policy loans suddenly become income taxable. For some seniors, this can mean tens of thousands of dollars in surprise taxes.

- Worse, you lose your life insurance coverage at the very time you may still need it.

Most policyholders are not even aware of this. They think that their IUL will take care of itself after several years of payments, and then they get caught off guard with lapses in their retirement. And since the policies have such structures that are difficult to track, individuals do not even know that their balance is dwindling until it’s too late.

This alone makes IUL a risky venue to store your retirement funds. With a regular investment account, you can experience market fluctuations, but you’ll never experience sudden devastation due to secret insurance fees.

6. Overpromised Growth Projections

If you’ve ever sat through an IUL sales pitch, you’ve probably seen the colorful charts and illustrations showing how your money will “grow steadily” while avoiding market downturns. These projections are designed to wow you, but they’re often overly optimistic and misleading.

Insurance agents generally employ projections based on past averages or the highest cap rate that was available when they made the projection. They’ll use numbers that make the policy perform better than straight investments. But the issue is:

Unrealistic Projections: These figures tend to project the highest cap and participation rates when, in fact, insurance companies can (and do) reduce them in the future.

Ignoring Fee Drag: Most graphs play down or entirely ignore the actual effect of administrative fees, mortality charges, and policy expenses, which significantly reduce returns.

Best-Case Scenarios Only: Agents emphasize the “perfect storm” scenario—consistent growth with no weak years—when in fact policyholders seldom experience those results.

Most individuals purchase IUL contracts on the basis of such optimistic projections, only to find a decade down the line that their returns are far from their projections. Such disappointment becomes worse over time, particularly as loan interest and fees accrue.

At the end of the day, IUL projections are marketing devices, not accurate predictions. If a financial product must depend on inflated figures to appear attractive, that is all you have to know.

7. Better Alternatives Exist

Another obvious reason IULs are a terrible investment is plain: there are much better options out there for accumulating wealth and planning for retirement.

Let’s consider a few:

- Traditional Retirement Accounts (401k, IRA): These accounts provide tax-deferred or tax-free growth with much fewer strings than IUL policies. And your contributions usually have employer matches, which amounts to essentially free money.

- Roth IRA and Roth 401k: These hold tax-free withdrawals, not like IUL loans. When you qualify, your returns accumulate tax-free, and you withdraw without fear of surprise tax bills.

- Low-Cost Index Funds and ETFs: With expense ratios of 0.03%, these investments provide you direct exposure to the market without caps, spreads, or complex rules. In the long run, they have always beaten IUL returns.

- Real Estate and Other Assets: If diversification is your aim, real estate and other physical investments tend to have greater growth potential with greater control than an insurance product.

The fact is, IUL is attempting to play in an area where it doesn’t belong. It’s sold as an “investment” when what it actually is is a costly insurance contract with some market-linked bells and whistles attached. If building wealth is important to you, keeping with time-tested strategies such as retirement accounts and index investing will treat you much better than tying money up in an IUL.

8. Lack of Liquidity

When you invest in an IUL, you’re basically putting your money into something that doesn’t provide you easy access to your funds. Unlike a savings account or a brokerage account where you can freely withdraw your money, IULs have restrictions and traps.

Here’s why liquidity is such a big issue:

- Policy Loans Rather Than Withdrawals: To withdraw your funds, you don’t just withdraw them—you borrow against them. This results in you paying interest on your own money, and accumulating unnecessary debt.

- Loan Traps: If your borrowed value becomes too great or your policy performs poorly, you can lapse the policy, which results in tax charges and loss of protection.

- Surrender Fees: Most IULs come with surrender periods that range from 10–15 years. If you cancel the policy early, you might forfeit most of your cash value.

Compare that to a Roth IRA or brokerage account, where you retain much greater control over your funds. Even subject to penalty for an early withdrawal, you’re not contending with the labyrinth of rules, charges, and hazards of an IUL.

Liquidity is important because anything can happen in life. If you put your money away in an IUL, you’re restricting your ability to be flexible in case of emergencies, opportunities, or changes in goals. And that’s a big disadvantage most don’t see until they can’t.

9. Reliance on Stability

Another largely ignored problem with IULs is that your returns and benefits are highly subject to the insurance company’s discretion and financial condition. In contrast to investing in the market directly, where your returns track real asset appreciation, IULs depend upon the insurance company’s management of crediting rates and policy conditions.

Here’s what that implies:

- Crediting Rate Manipulation: The firm can reduce participation rates or top rates at any given moment, cutting the amount of growth you actually earn—despite a surging market.

- Company Stability: If the insurance firm gets into financial difficulty, your policy can be affected directly. Insurers are governed, but not risk-proof.

- Policyholder Disadvantage: The firm is always in charge. They determine how interest is credited, how costs are arranged, and how caps are enforced. You have little say after signing the contract.

This renders IULs a gamble on the future actions of an insurance company. In comparison, when you’re buying low-cost funds or retirement accounts, you’re investing in real assets with long-term potential for growth—not depending on a company to “credit” you according to their own calculations.

10. Unsuitable for Most Investors

Last of all, the worst thing about IULs is that they’re just not right for the typical investor.

Who Does It Really Benefit? IULs are structured so as to favor highly compensated individuals who have already exhausted their retirement accounts and seek an extra tax-deferred outlet. And even in that case, most financial analysts posit there remain better alternatives.

- Average Investor’s Shortcoming: For the average investor attempting to save for retirement or financial freedom, IULs are more issue than solution. High fees, complexity, and risk exceed any possible gain.

- Agent Overbenefit: Come on—the primary individuals who really benefit from IUL policies are the agents who sell them. Their commissions are enormous, sometimes as high as 80–100% of first-year premiums. That incentive alone should give you pause.

In brief, IULs are schemes that sound good when promoted but seldom perform as promised. For the average investor, adherence to plain, straightforward, and well-tested techniques such as retirement accounts, index funds, or real estate is much wiser and less perilous.

Key Questions to Ask Before Buying an IUL Policy

- Considering an Indexed Universal Life (IUL) insurance policy? Before you sign up, ensure you receive definitive answers to these crucial questions:

- How are premiums structured? – Determine whether premiums are fixed or variable, and how future modifications might influence your policy.

- Which market indexes are tied to growth? – Ask which stock indexes your cash value is linked to and how they calculate your returns.

- What are the limits on growth? – Know both the limit on returns and the participation rate, so you know how much of the performance of the market you’ll actually get.

- Is there a minimum guaranteed return? – Find out what minimum interest rate is guaranteed if the market does badly.

- Can I vary my premiums? – Make sure to find out how variable the payments are and if you can pay more, less or miss contributions.

- What will I be paying in fees? – Review a complete rundown of charges such as insurance fees, admin fees, surrender fees, and any other lurking fees.

- Can I take a loan or withdrawal from the policy? – Find out about guidelines for drawing on your cash value via loans or withdrawals and its impact on the death benefit.

- What are the tax implications? – Know how the loans, withdrawals, and ultimate payments will be handled in taxation.

- How will market conditions affect the policy? – Determine how the fluctuations in stock performance or interest rates can affect your long-term performance and whether your policy may need to be maintained with higher premiums.

Conclusion: Why iul is a bad investment

Indexed Universal Life Insurance can be sold as a potent investment and retirement vehicle, but if you look deeper, the negatives are impossible to miss. From excessive fees and dishonest tax guarantees to subpar returns and illiquidity, IULs are filled with disadvantages that make them inappropriate for most individuals.

The truth is, IULs are more about profit for the insurance companies and agents than value for the policyholder. If you’re serious about building wealth, focus on strategies that are transparent, proven, and built on actual assets rather than complicated insurance contracts.

Your financial future should be in your control—not tied up in a product that benefits others more than it benefits you.